SCOPEWORKER PAY

AR, AP, Supply Chain Financing

Choose as much or as little automation as you're comfortable with

Optimize spend, create transparency

Same Day Pay

Invoice reconciliation, approval (partial or full) and payment on the same day suppliers complete work.

All Suppliers, One Invoice

Combine all supplier invoices into one monthly invoice, aligned with extensive empirical data.

Extended Payment

With Same Day Pay, buyers can extend payment terms to maximize cash flow.

Zero Based Budgeting

Live financial data enables budgets to be accurately built from a zero base regardless of previous budgets.

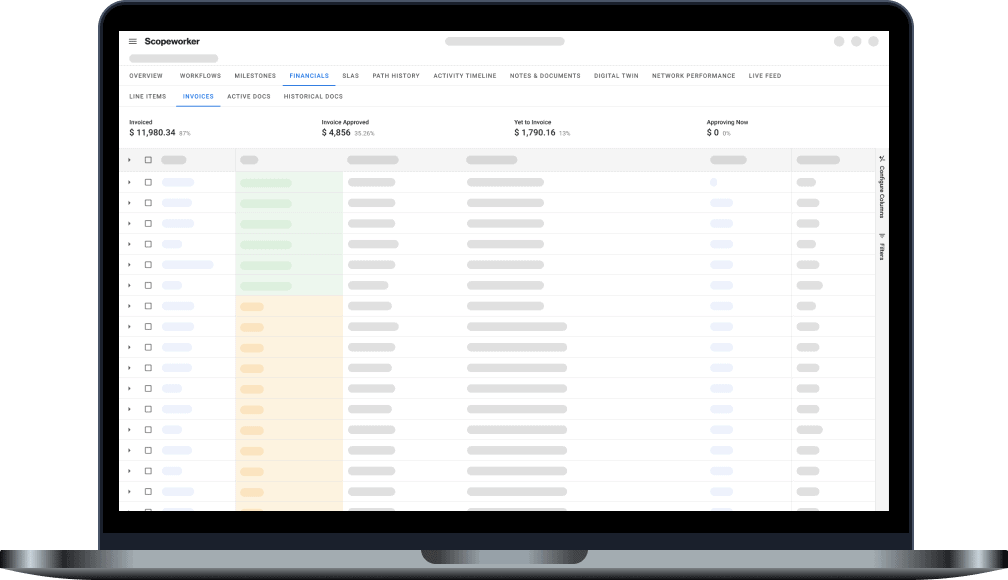

A foundation for touchless invoice processing

Invoice Generation

Upon buyer acceptance of supplier deliverables, the invoice is auto-generated for the supplier's review, edit and submission.

Reconciliation

Reconciliation is instant as the PO, work order, supplier execution and goods receipt are carried out in Scopeworker.

Invoice Approval

For simplistic tasks, Scopeworker can auto approve invoices for payment when the buyer approves the supplier's close-out package.

Partial Approval

ERP Automation

Supply Chain Finance

A range of Supply Chain financing products that lower the barrier of entry for cost effective diversity suppliers to enter the marketplace.

Uniquely connect supplier service execution to your AP

Is your AP team wasting time reconciling PO-based invoices, approving non-standard invoices, and processing exceptions? Scopeworker streamlines the AP process with full audit trails from invoice reconciliation to payment.

Supplier closeout automates purchase orders into invoices

Upon closeout acceptance, invoices can be fully or partially generated ready for instant review by the buyer. The supplier has live visibility of invoice status from receipt to final payment. All invoices are digitally signed and can be accessed at any time.

ENTERPRISE FINANCING

Same Day Pay supports >90 days buyer payment terms

It takes months to reconcile invoices with legacy Procure-to-Pay

Historically, invoice reconciliation for supplier services is a manual process of the buyer and supplier using email to compare excel spreadsheets with Procure-to-Pay platforms, milestone databases and field force apps. This process can take months and prevents the engagement of smalll, cost effective suppliers.

Same Day Pay lowers barriers for cost effective, small suppliers

With Scopeworker, approving a supplier's closeout package auto-reconciles an invoice for delayed, partial or full approval. This enables small / diversity suppliers to select Scopeworker's Same Day Pay supply chain financing on the day work is complete, months before legacy procure-to-pay platforms. Buyer payment terms remain the same.

All suppliers, one monthly invoice with all back-up data

Centralized control with decentralized execution

Supporting Sarbanes-Oxley auditability, Scopeworker enables decentralized markets to have autonomy of local strategy while allowing the finance department to have total transparency and centralized cost control. Finance departments have live analysis of costs across projects, markets, regions and countries.

Live analytics drive management by exception

With live transparency of every dollar spent, Finance departments can manage by exception financial coding, purchase orders and change orders, invoice management and supplier SLAs. Financial items requiring manual review can be defined at a global or commodity level.